PERSPECTIVES #7

The need for flexibility in the energy system – illustrating the electricity market during COVID-19 lockdowns

Télécharger l’intégralité du document en PDFThe need for flexibility of the power system is a topic which is progressively finding its way in the public space. In this paper we propose to explain its rationale, to illustrate it through the analysis of the energy system in 2020 during the lockdowns implemented in some key European countries and to show how it can make up a compelling investment theme. The analysis of the Covid-19 impact on the energy system is particularly relevant because it has implied for some periods a higher share of variable renewable energy sources in the supply mix (resulting from a combination of lower demand and favorable weather conditions), up to levels which are precisely expected to form the “new normal” in a few years from now (around 2030) as part of the energy transition ongoing in Europe. Such higher share of variable and decentralized renewable energy sources entails grid management issues which are one of the foundations of TiLT Capital investment thesis.

The power system relies on two fundamental principles:

First, it requires a real-time and locational balance between load and supply to function properly, i.e. to avoid a collapse which means a black-out. This balance is all the easier to achieve that the load and supply sources are accurately predicted and/or that flexible sources of load and supply can be called upon on short notice to offset the prediction errors (these latter means are called reserves). It can therefore happen equally when demand overwhelms supply or in reverse situation (low demand).

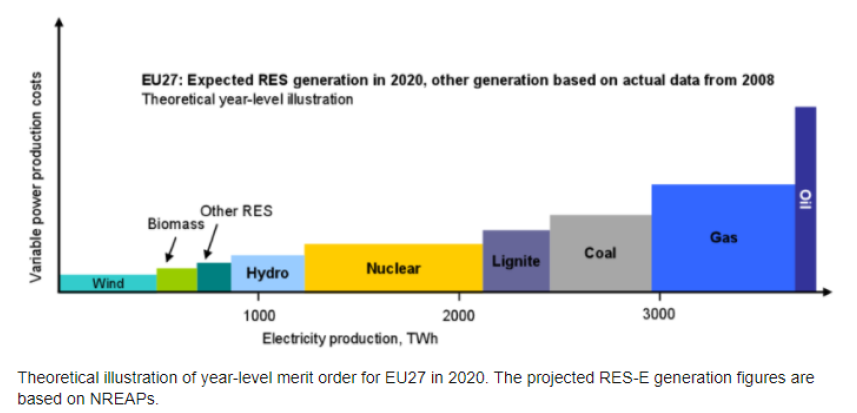

Second, it follows a merit order: production units are in principle called by increasing order of marginal (~variable) production cost, meaning that (near)zero-marginal-cost of renewable energy sources like wind/solar/hydro are typically called first, then nuclear power plant and fossil-fueled plants (coal/gas/oil). Furthermore, markets have been designed by authorities by incentivizing renewable energy sources and awarding them a priority of dispatch over other energy sources in any case.

Impact of lockdowns:

The almost full closure of industries and tertiary activities has highly flattened the consumption curve during the working hours: peak demand has decreased on average by 15 to 20% in most European countries. While the correlative increase on power consumption in the residential sector has more or less offset the decrease of tertiary consumption1, the main source of the load decrease was in industries (e.g. automotive industry, metallurgy, chemicals, etc.).

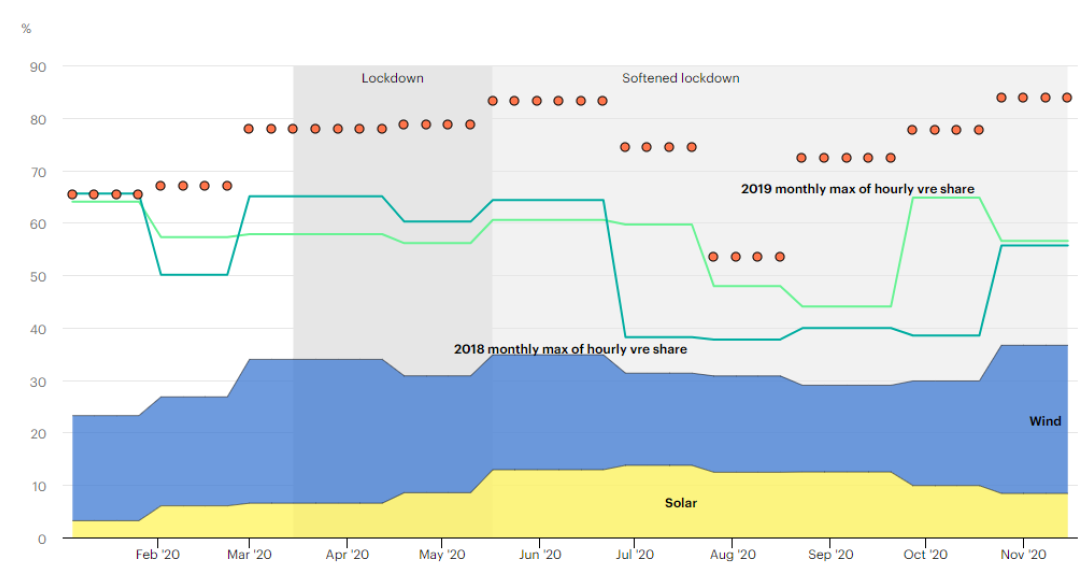

Combined with favorable weather conditions and hence greater wind and solar power output, the lower load has shifted “to the left” the point of equilibrium in the merit order, translating into a significant increase of the average -and even more peak- share of renewables into the supply mix (as illustrated by the graphic below from the International Energy Agency where the red dots representing the maximum share of hourly intermittent renewables during the month, for Italy: the share of variable renewables in has jumped to 80% on average vs 40-60% historically).

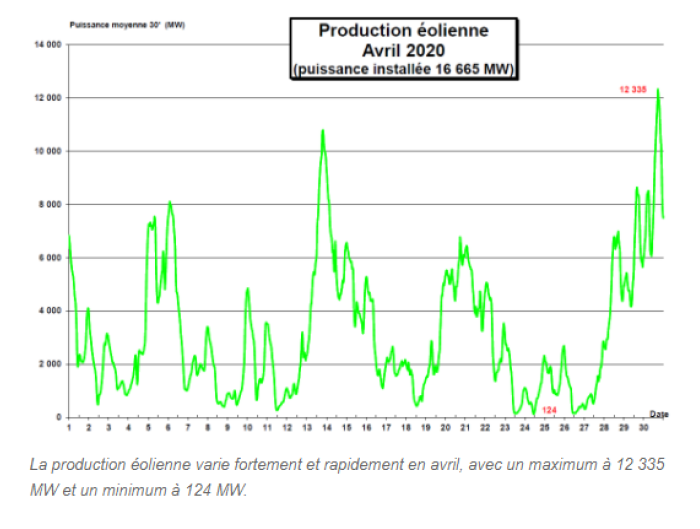

Although stemming from favorable weather conditions, this changing supply mix has brought a lot of entropy in the system because these weather conditions are variable: for example, the French wind contribution has ranged in April from a minimum power of 124 MW to a maximum power of nearly 12GW (that is 100x more) (source: Le Monde blog). Likewise, UK renewables output has been volatile: during the week commencing 4 May, wind averaged 9.2 per cent of the generation mix for the first six days of the week before jumping to 41 per cent on 10 May (source Oxford Institute for Energy Studies).

Grid management

Consequently, the system operators have had to adapt the grid management much more rapidly and flexibly than in the past. The drop in demand has removed a key source of flexibility: industrial plants often act as grid stabilizers by using their own power generators to help balance the grid.

Also, at times of high variable renewable energy supply, little conventional plant has been running (because out of the merit order) meaning that significant volumes of spinning turbines on the system could not contribute, then the system loses inertia and becomes unstable: as a consequence of less synchronous machines operating, system strength and damping capabilities were reduced in the European continental system.

CIGRE (Conseil International des Grands Réseaux Electriques) has documented the grid operators‘ actions in its report “System Operations impact of Covid-19: European Perspective » in reaction to the reshaping of load curve (slope and shape) and load forecast error): redispatching, reverse flows, temporary lines disconnection, increased recourse to congestion and ancillary services (calling additional regulating units to achieve sufficient support for voltage regulation), coordination with distribution companies and customers, etc. Also, in most of the European countries, planned outages for maintenance have been re-evaluated, postponed, or even cancelled which is not without consequences for the grid management in the short-term future2.

Consequences on the system and power market: several impacts can be listed: increase of blackout risk, increase of balancing costs, negative prices on the gross market, curtailment of production.

No black-out has occurred in Europe, but the risk had increased. In its November 2020 World Energy Markets Observatory, CapGemini reports that “near blackouts” happened in Germany and in the UK, where the system margin was particularly thin (in terms of the available capacity of flexibility levers to maintain frequency and voltage within operating range). For example in France, the call for tender for demand response has doubled the 2021 tariff to regain downwards flexible capacity. In the UK, the transmission and distribution system operators have obtained emergency powers to disconnect so-called embedded generation (residential solar) as a last resort measure.

Outside of Europe, there has been rolling blackouts in California, where the grid operator has a regular high peak % of variable renewables in its mix, which represent a challenge on hot summer evenings, when electricity from solar generation drops to zero but demand for air conditioning remains high (this is expected to intensify as California adds more PV and wind to meet its targets of 60% renewable electricity by 2030 while phasing out fossil fuel and nuclear plants schedulable generation).

Balancing costs have been ramping up as a result of the lockdown and increased penetration of renewables:

- In the UK, according to OFGEM, the UK regulator, there has been a c. 40% (£700m) increase in balancing costs vs. expectations in Q2 alone of UK GB electricity system explained mostly by the “high level of renewables output, which required the TSO to take a large number of actions to balance the system and ensure system operability”. Balancing costs as a percentage of quarterly energy costs rose to over 20 per cent in the first half of 2020, compared to about 5 per cent over the last decade and 10 per cent last year (Source: Oxford Institute for Energy Studies – OIES).

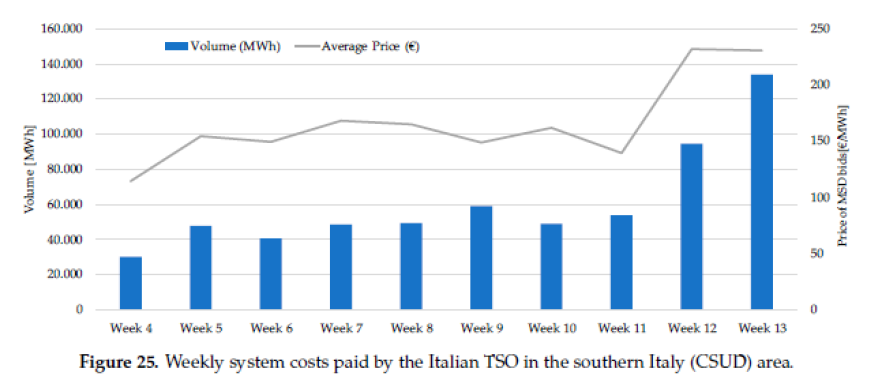

- In Italy, on a weekly basis, balancing cost paid by Italian TSO increased by 70 to 100% during the lock down period, due to an increase of both balancing volumes (#MWh) and unit balancing costs (in €/MWh), particularly in southern areas of stronger installed intermittent RES generators:

- Price effect: the decrease of load shifted the merit order downwards, shutting down more expensive flexible sources which could not contribute to the inertia of the system (ie less synchronous sources) and are then more costly to act as flexibility providers.

- Volume effect: a higher proportion of renewable in the system increased the occurrences of balancing requirement (due its variability)

These balancing costs are ultimately charged to suppliers/generators but are in fine born by consumers. They will be a regular feature in the future: Increased renewable penetration will drive low residual demand levels similar to those seen recently and a return to higher commodity prices would even increase costs of system actions and could lead to higher balancing costs (ceteris paribus).

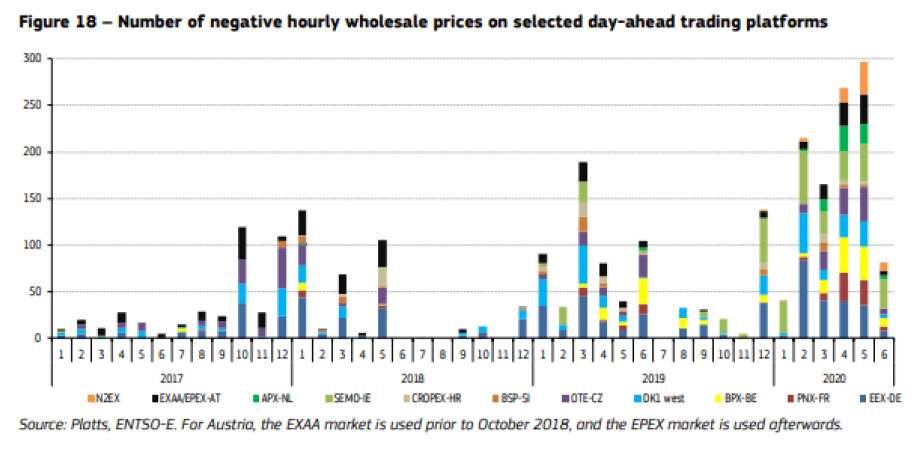

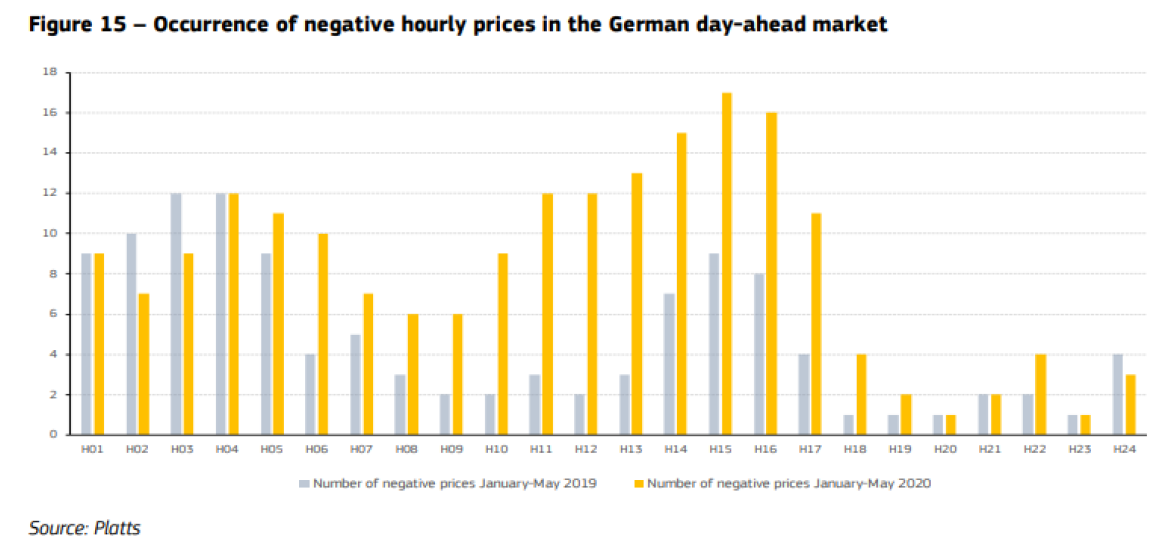

The frequency of negative prices on the gross market has significantly increased in Europe: some conventional generators are bidding negative price for a short period in the market because it would cost them more to shut down their production due to technical design of their installations (ie more than paying their customers to offtake their production). Incidents of negative prices are increasing, with 773 negative prices recorded for 15-minute contracts in the first three months of the year, a 78% increase from the same period a year ago, according to Epex Spot exchange data.

At 648, the number of hours with negative wholesale prices in Germany Q2 2020 was almost three times larger in the observed bidding zones than in the previous Q2. Record low electricity consumption and rising renewable generation brought more cases of negative prices even to markets which traditionally do not display many such instances, such as the Netherlands, France, Hungary and the UK.

While this is a mere result from the functioning of the market, this is obviously unsustainable for the generators and the supply system as a whole. And negative wholesale prices rarely get through to consumers (and sometimes not even to generators sheltered by support schemes for renewables)3.

Curtailment:

In the UK, the TSO has used traditional flexibility contributors but this was not enough: it has had to curtail renewable energy sources, paying producers to shut down (several hundreds of £m); this is obviously suboptimal4, curtailment as seen in the UK or Germany go against the main policy need of reaching a net-zero system. Outside Europe, In California, for instance, for the first quarter of 2020, curtailments of renewables were twice as high as in the first quarter of 2019 (source: Oxford Institute for Energy Studies). Mexico has taken radical measures to preserve its national energy security during the COVID-19 pandemic: in Q2, the government significantly increased grid connection fees for renewable power plants (up to nine-fold) and introduced restrictions on grid connections for new wind and solar power projects. Such measures have already existed for a few years in China where renewables operators face grid penalties and electricity curtailment. They are strongly incentivized to be equipped with their own balancing systems (hybrid farms with battery storage for example) and precise weather and generation forecasts.

Why does it matter for the future?

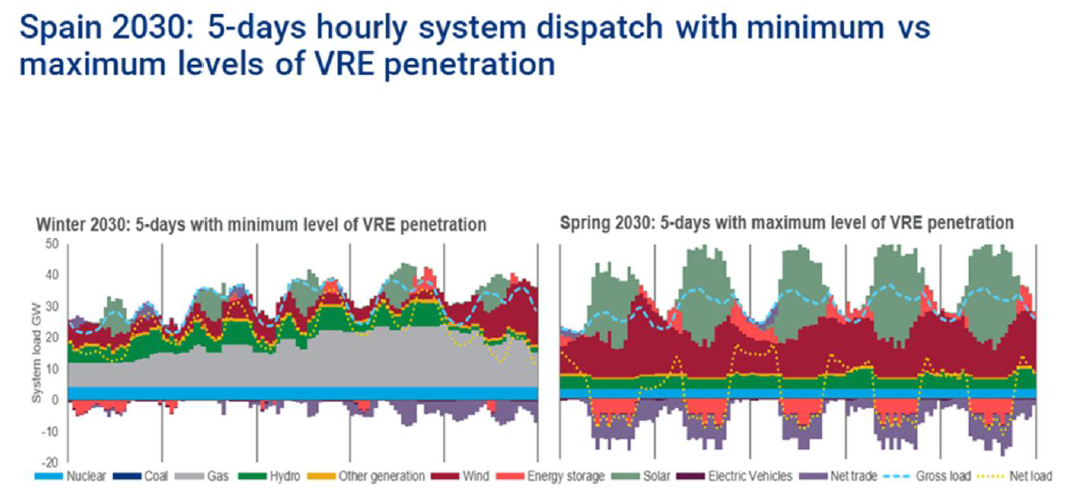

The lockdown impact on the energy system provides a glimpse into the future when variable renewable energy will make up a higher proportion of power supply on a regular basis. Power systems will need new sources of flexibility at different rates, some sooner than others depending on their situation; for example, UK has low levels of interconnection, an accelerated coal decommissioning program and the biggest offshore wind fleet in Europe while France has a resilient and diverse fully interconnected power system plus a relatively flexible nuclear fleet.

The graphics above illustrate this situation according to the power capacity mix expectation in Spain (Source: power system flexibility key to Europe’s net zero targets WMK 2020), showing the resulting net load (i.e. net of non-dispatchable renewables). Even in case of minimum renewables (left) or maximum level of renewables (right), the hourly net load shows high level of variability, requiring solutions for power grid management akin to those required during the lock down triggered by the covid-19 pandemic.

A conclusion to be drawn from this specific situation: a confirmation of the increased need of flexibility of the power system, deriving from the inevitable transformation of the energy system.

More decentralized and renewable generation requires several features, to name but a few: improved supply/load forecasting, means to create and interact with flexible demand to match supply: demand management, optimization and response, control and dispatch throughout the system (via digitalization), creating smart components / smart asset management throughout the system: smart grid, smart supply, smart load, short/mid/long term energy storage, etc. All of these represent as many investment opportunities as backbone components of the energy transition.

1 It is nevertheless worth mentioning that it is not neutral overall as large tertiary buildings benefit in principle from high efficiencies in terms of heating, cooling and lighting which is most often not the case in dwellings.

2 For example in France, where the flexibility is managed through nuke and hydro modulation: the postponement of nuclear maintenance -because it was used for modulation during the lock down- has derailed the program which was expected for the nuclear fleet: lowering its production during the lockdown hampers its capacity for next winter due to impact on the neutronics of the reactor, even more than the partial renewal of nuclear fuel has not taken place)

3 Mechanically, negative wholesale electricity prices have even coincided with rising final tariffs: In Germany, for instance, network charges (per kWh) increased to recover fixed costs from lower throughput, subsidies for renewables rose with higher renewables output, and balancing charges increased.

4 See also TiLT Perspectives #1