With Net Zero pledges flourishing and energy as well as CO2 prices recently going through the roof (except for oil, all energy commodities have broken record price levels in the last months), the whole industry, and one could say the whole world, is now looking for the solution to decarbonizing the economy while keeping the cost of such process socially and economically viable.

This quest has led to an acceleration of investments announcements of massive proportions, from batteries giga factories each in the cost of billions, pledges towards hydrogen economy in the tens of billions and a revival of nuclear energy in the hundreds of billions if the plans materialize.

These investments needs and programs come in a period of unprecedented cheap money that washes the economy with cash seeking to find deployment opportunities. The risk for investors is for these massive investments to turn out not to be the best ones or not as profitable as expected, because pace of deployment will eventually prove to have been overly optimistic.

From a behavioral perspective, it transforms many investors, entrepreneurs and experts into werewolves hunters: they all seek for silver bullets. For some, electrification and batteries have settled the debate and are by far the best option, hydrogen being a “ridiculous option”. For others, hydrogen is the missing link and solves all issues of transformation of the energy sector because it is a highly flexible energy vector with greater density than batteries. And nuclear energy proponents explain that renewables and other “new energy dreams” are so inefficient that nuclear is the only credible option to decarbonize the energy sector.

Unsurprisingly to our readers, we disagree with these – caricatural indeed – views and believe that there are no silver bullets to fight the double challenge of climate change and energy affordability. Rather, a series of complementary solutions (not weapons) will pave the way to an efficient energy and just transition much more adequately.

We hence propose to give a quick overview of the merits and drawbacks of three of the hotter topics agitating the energy transition world, namely batteries, hydrogen and nuclear and then to show how these technologies are in fact complementary based on local conditions and usages.

From hot topics to burning hot topics?

In the last year only and on the backdrop of net zero pledges from governments and corporations, several plans representing hundreds of billion euros investment in Europe only have been announced: batteries giga factories in Finland, Norway, Germany, France, respectively €9bn, €8bn and €7bn hydrogen programs in Germany, Spain and France, the revival of the nuclear option with a possible inclusion in the EU Taxonomy, a possible 6 EPR program in France and other plans in the UK and Poland.

Strikingly, these announcements often come with grand declarations regarding how such technology is the definitive answer to the energy transition and to fighting climate change. Given the volumes of investments at stake, we wished to provide a somewhat more nuanced view of three topics that are so hot that they regularly make front pages of various media outlets, professional or destined to a wider audience.

Batteries

Since the mid-2010s, battery-storage has been one of the hottest topics in the energy market because it is directly linked to the core trend of electrification: electrification of transportation mostly, but also massive development of renewable energies that further reinforce the prominence of electricity on the energy mix of the future.

Storing electricity in batteries is nothing new. Yet, storing electricity in an efficient way was sort of the holy grail for the energy sector. The whole electricity system was built on the premise that electricity cannot be stored “en masse” efficiently. Hence the need to systematically balance demand and supply and more adequately, to adapt supply to demand.

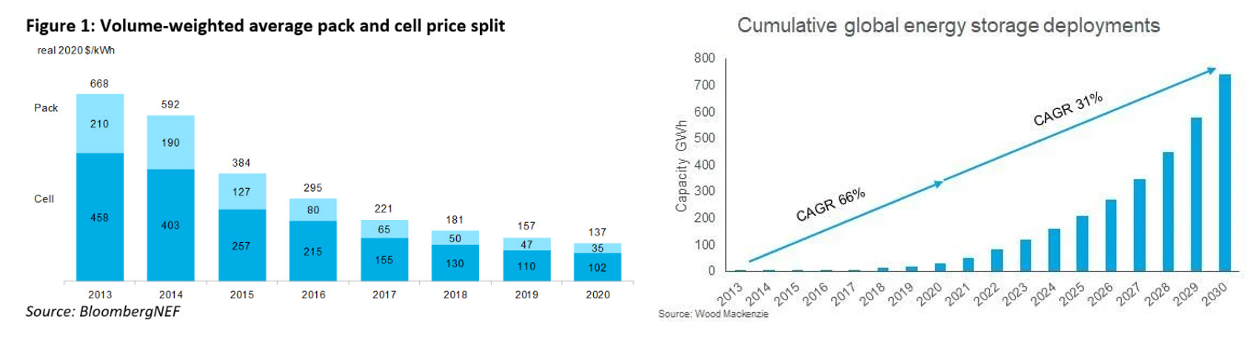

We focus here on the merits or drawbacks of Lithium-Ion (Cobalt, Manganese, Phosphate) batteries relative to either widespread energy carriers (fossil fuels, hydrogen) or to other types of batteries. We consider that compressed air energy storage, flywheels, pumped hydro etc. are rather niche application for utility storage. What these new batteries chemistries based on Lithium-Ion bring to the equation is this ability to store electricity efficiently, primarily for light duty transportation purposes. This translates into spectacular cost decrease of MWh of storage and parallel increase in batteries storage deployment (see charts below).

This structural trend of improvement of the economic proposal of batteries, driven mostly by electrification of transportation and the announced end of Internal Combustion Engines on grounds of decarbonization, has helped create momentum for stationary applications. This has translated into a significant decrease in the Levelized Cost of Storage (the remuneration needed in €/MWh or $/MWh to achieve an IRR equal to a designated cost of equity).

NorthVolt, Verkor, Tesla, ACC, Stellantis, etc., over 30 giga factories are under construction or have been announced in Europe only, while investors and developers have started piling up stationary storage projects all over the world, either as renewable energy firming, grid capex deferral or grid services providers.

On this backdrop, it could be tempting to see these developments and improved economic equation as a silver bullet solving the major issue of electricity storage. This was for example Bloomberg NEF’s view as stated in their 2018 study regarding the least cost option to decarbonize the German energy mix.

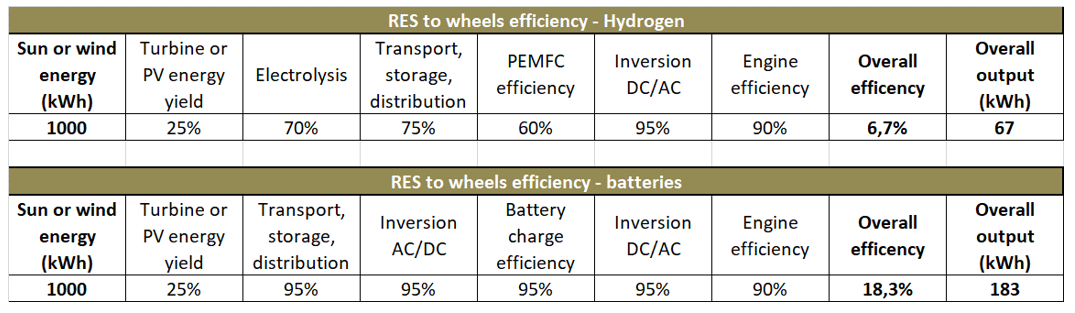

Yet, however compelling the advantages of batteries in the context of energy transition, they also come with drawbacks that fail to heed some key concerns linked to the transition to a new energy system. The following table shows a quick overview of the advantages and drawbacks of batteries.

On this basis, Lithium-based batteries have rendered possible both the electrification of transportation and the storage or electricity for stationary applications. They seem particularly well suited for:

- 1h to 4-6h of storage;

- Electrical grids CapEx deferrals: strategically placed stationary storage can be a solution to avoid large investment at grid level by offering an efficient management option of local congestions.

- Distributed energy management and local demand-response management: with residential PV, electrical heat pumps, residential EV charging, etc. proliferating, batteries may appear as a suitable solution to act as the energy manager of distributed energy assets.

As storage has become one of the hottest topics in the energy industry, R&D and optimization of existing chemistries are very active. It is worth noting that several other storage solutions exist or emerge beyond lithium-based batteries, such as flow batteries, Air-Zinc, Carbon-Electrode or Lithium Sulfur batteries, etc. All these developments seek to answer specific issues such as long-duration storage, charging time, environmental impact of batteries production cycle, etc.

While Lithium-based batteries have revolutionized electricity storage – hence the 2019 Nobel Prize in Chemistry awarded to John B. Goodenough, Stanley Whittingham and Akira Yoshino for the development of Li-Ion batteries in the 1970s – and paves the way for electrification of transportation, they still present numerous challenges. They are and will be an essential component of energy transition, but they do not alone answer the need for efficient storage for all types of applications.

Hydrogen

In a recent conversation with the chief of a major R&D center, she was expressing her surprise at the amount of money that is being poured into the hydrogen economy. From R&D to electrolyzers or fuel cells development, hundreds of billions of euros are being committed and channeled to make the hydrogen economy emerge.

To understand the craze for hydrogen in recent years, it is important to understand the notion of “energy vector”. An energy vector allows to transfer, in space and time, a quantity of energy. In that regard, hydrogen is a very efficient and flexible energy vector, given its high energy density and flexibility of usage. It is in particular much more flexible than electricity, because it can be easily stored.

Today, 88 Mt of (grey) hydrogen are produced each year, used in refineries and industry (mostly under the form of ammonia). Between 2018 and 2020, hydrogen production has increased by 20%.

However, there are two major hurdles to the development of hydrogen as pivotal energy vector:

- the GHG emissions content for hydrogen production is quite high given that most of the production comes from a technique called Steam Methane Reforming, based on fossil fuel. The current production of 88 Mt (a fairly small market of ~ €100bn/yr at current market price, 0.1% of world GDP) represents roughly 1bn TCO2eq. (2% of total GHG emissions)

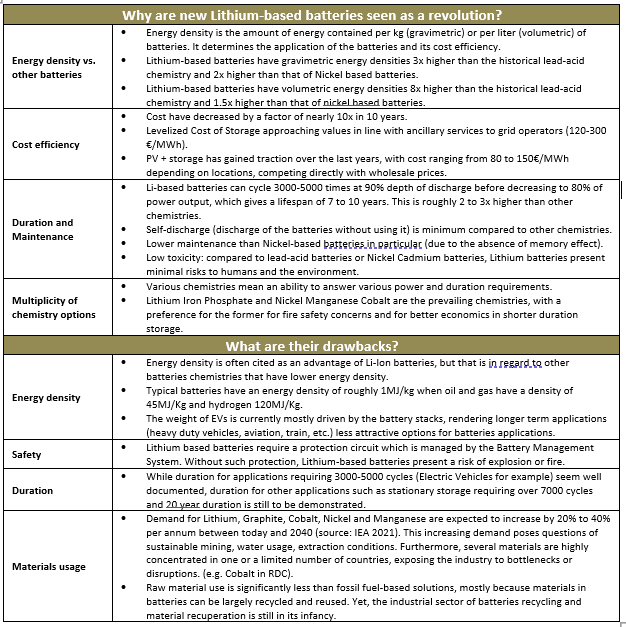

- the efficiency of a hydrogen chain (from hydrogen production to hydrogen utilization) is still fairly low compared to batteries, as shown in the following table:

This table calls two comments:

- the major difference between hydrogen and batteries come from the losses in the electrolysis process (assuming here a 60% load factor) and in the transportation, storage and distribution processes. Hydrogen storage in particular requires compression, which is quite energy consuming. It would be further deteriorated if hydrogen were to be transported and stored under a liquid form, as it would require adding a cryogenic step at -253°C.

- Minimizing the number of steps between primary energy and energy usage is essential to maximizing energy yield. For hydrogen, direct use in industrial processes for example, or valorizing by-products such as oxygen (electrolysis) or solid carbon (methane pyrolysis) could be a way to enhance the economic equation.

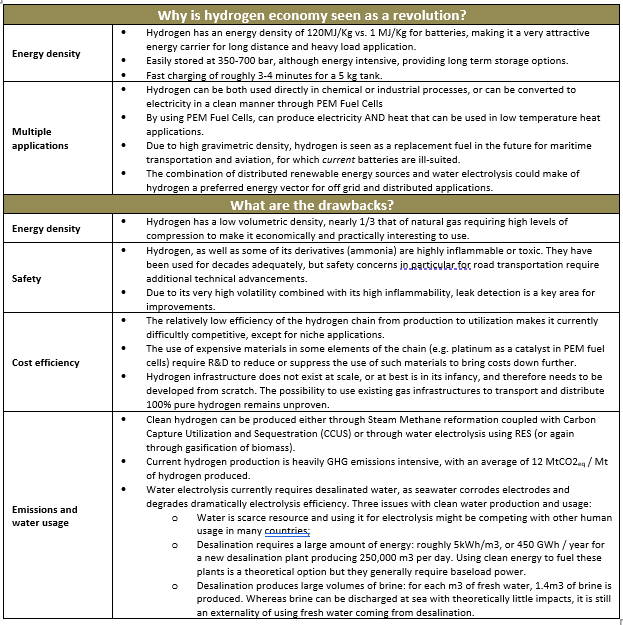

Drawing upon these elements, looking at hydrogen from the perspective of its current merits draws a cautionary tale. As anticipated, the following table shows a quick overview of the advantages and drawbacks of hydrogen:

Advancements in materials science and chemistry for storage, electrolyzers and fuel cells have greatly improved the attractiveness of hydrogen and its cost efficiency for commercial use. With its high gravimetric density, it has great potential applications for:

- stationary long term storage by electrolyzing excess renewable power during the day and delivering it throughout the night when short term storage with batteries are not available anymore;

- heavy duty and long haul transportation, which is a key area for decarbonization. For such transport application, the weight of batteries compared to the energy delivered is probably not the adequate option to decarbonize for example the aviation industry;

- industrial applications could be expanded beyond ammonia production and oil refining, in particular as a means to decarbonize steel production. An EU experts group1 suggests that hydrogen could be an adequate reducing agent in replacement of coke (carbon) to reduce iron ore.

However, the perspective of a “hydrogen economy” seems at best optimist, and more likely a chimera in the short run. For transportation, the overall efficiency of the hydrogen chain is degraded by the need to transform renewable energy into hydrogen, and then back into electricity, not to mention the challenges of storage and safety. Water usage is also often overlooked, while it would certainly be an issue in certain places where water scarcity is already at play. Direct use of hydrogen in adequate locations hence appears as a much more attractive option, in particular to abate CO2 emissions in sectors such as steel production.

Nuclear

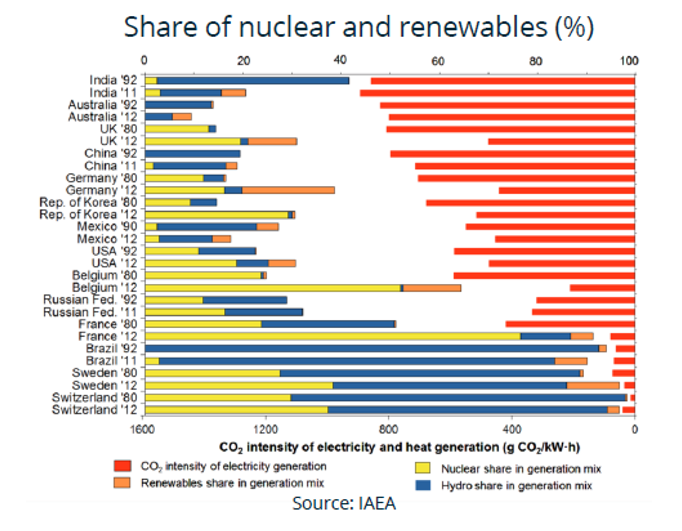

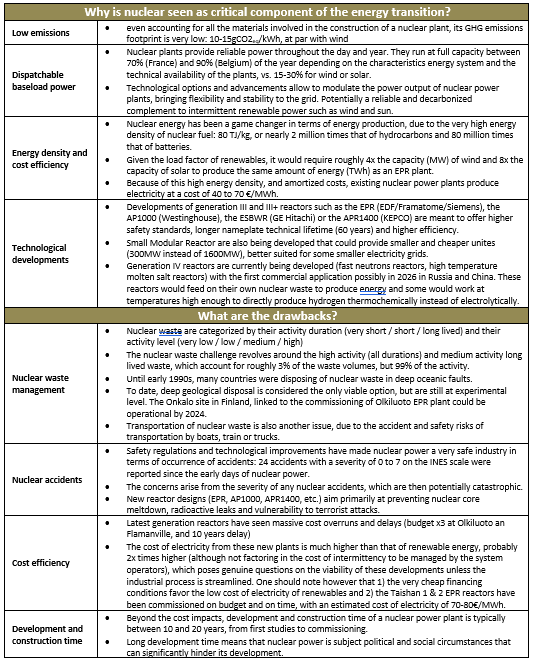

A highly controversial topic, nuclear energy is a poster child of the dilemmas that run through the energy world. This technology developed massively following the oil shocks of the 1970s offers 1) security of supply by diversifying the mix away from fossil fuels (Belgium, France, Switzerland) 2) low cost dispatchable baseload power to these same countries and 3) a significant reduction in the GHG emissions intensity of electricity generation, as shown in the chart below:

At the same time, the nuclear industry has experienced dramatic accidents since the late 1950s: 13 accidents >4 on the INES scale (ranging from 0 to 7) for civil nuclear accidents, with two 7-level accidents at Chernobyl in 1986 and Fukushima in 2011. Additionally, nuclear energy produces highly dangerous waste that need specific management and that pose real threats to humans and the environment if not handled properly.

For many years, nuclear energy was seen as considered a silver bullet to the double issue of energy security and emissions, the Chernobyl accident being considered as a failure rather of the former soviet system than of the technology itself. Fukushima changed this mindset and saw many countries accelerating the shutting down their nuclear program, the most prominent one being Germany (shut down decided in the early 2000s).

It is often said that this decision has driven a resurgence of coal and lignite consumption in this country, which is counterfactual. The massive development of renewables since 2011 (and drawing massively on Belgian and French interconnexions, essentially nuclear electricity) has enabled the country to reduce coal and lignite consumption. But the decision to phase out of nuclear has created issues of grid stability with the increasing share of renewables, increased the emissions content of baseload power and overall prevented Germany from decreasing further its emissions. In 2021 however, the lack of availability of nuclear, combined with low wind regime and increasing demand has led to a surge of coal and lignite in the German energy mix, jumping from 21% to 27%.

With current energy prices going through the roof in Europe and elsewhere, nuclear power is seeing a resurgence. The best indication is the debate over its inclusion in the EU Taxonomy, which determines which assets are considered “green”. This spurs a heated debate and we believe it is once again interesting to look at the merits and flaws of this technology.

Nuclear energy is highly controversial because of the severity of a potential nuclear accidents and of the unresolved issue of high activity and long-lived waste. But it is undeniable that in a context of urgency in combating climate change, it provides emissions free dispatchable power at potentially low cost, which are core features of any generation option suitable for the energy transition.

Yet again, given the magnitude of the issues of nuclear waste and safety, it would be a strong overstatement to consider current nuclear power – and its evolutions such as gen IV reactors – as the silver bullet for energy transition.

It is however very likely that removing coal from the energy equation by 2030 (on that topic, see TiLT Perspectives #5), and progressively displacing gas will be very difficult to achieve in an economically and socially viable way without some portion of nuclear plants in the mix to provide emissions free baseload power.

The good news is, we have a set of complementary options

By focusing on batteries, hydrogen and nuclear, we attempted to provide a balanced view of the merits and limitations of currently three of the most prominent topics in the space of energy transition.

The merits are obvious, and it is excellent news to see massive investments (both in R&D and in scaling up) in these areas, as it shows a clear commitment to finding solutions to decarbonize the energy system at an economically and socially viable cost.

The key takeaway on which we would like to insist is that none of these technologies are silver bullets. Their limitations make them unsuitable for certain applications or call for a very careful balancing of the risks versus the benefits. Brought together however, they could certainly be the pillars of the energy transition of the next two-three decades.

Furthermore, while these technologies may be each part of the answer to the current challenges of energy transition, they may only be a step towards a new system, not necessarily the end game. More intelligent grids and demand management would substantially change the generation needs. The massive development of offshore wind, especially with floating technology, could deliver more easily predictable clean energy given the reliability of wind at sea and consequent high load factors (>50%).

And finally, nuclear fusion would probably be significant evolution and likely a game changer by solving two of the major limitations of current (fission) nuclear plants: 1) it generates no high activity waste and only low activity long lived waste with around 100 years of radioactivity, instead of millions of years and 2) nuclear accidents are considered almost impossible, as nuclear fusion is not based on a chain reaction: any change in the parameters would instantly stop the nuclear activity. The main limitation of fusion is its time horizon: commercially viable reactors are not expected before… 2070.

However, the Space X example should lead us to a bit of optimism. The industrial space sector deemed for decades as impermeable to new entrants has been disrupted by agile new companies. Many start-ups are working on bringing nuclear fusion to market much quicker than the larger experiments such as ITER. But the physics behind nuclear fusion may prove to form a barrier too complex for small companies to overcome and it is generally agreed that even considering possible disruptions from new entrants, nuclear fusion before 2050-2060 is very unlikely.

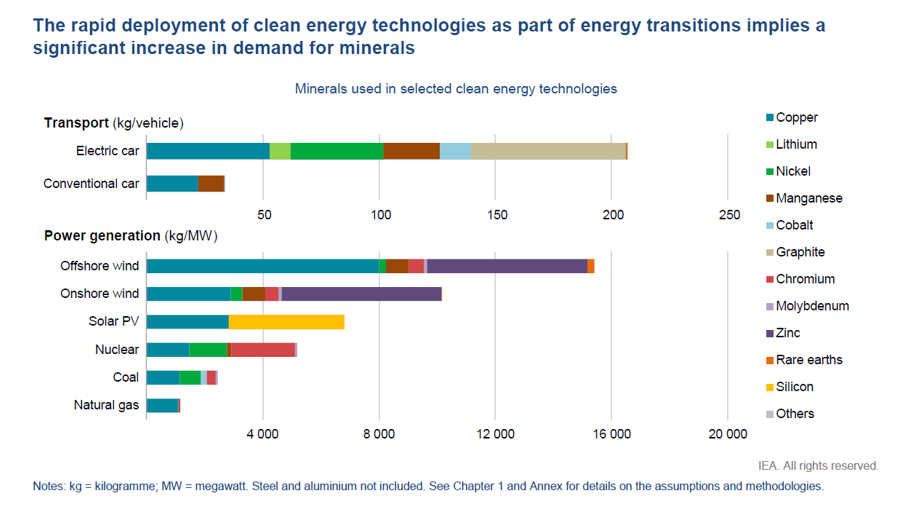

Finally, there is one common limitation to all these technologies that illustrates the complexity of achieving a truly sustainable energy transition: they all rely heavily on minerals (metals and rare earths), as shown in the chart below:

Nuclear fusion would exhibit the same trend, with copper in particular a critical element for the huge magnetic coils used in the Tokamak to produce the confinement magnetic field.

As we attempt to transition urgently away from fossil fuels for obvious reasons, the risk is that we reproduce the same mistakes of disregarding new negative externalities stemming from our massive investments into clean technologies. If ignoring the externalities of burning fossil fuels for over a century led to the current unsustainable climate change, ignoring the challenges of mining for evermore minerals could lead to very significant unintended consequences. So it is up to us to incorporate the full environmental and social costs in the technological options we will pursue, and to assess their merits overall.

It is also critical to be able to cast over these hot trends a critical eye: we may remember the false start of the clean tech sector in the late 2000’s early 2010’s. On many counts, this wave seems different, supported by fundamental trends and a sense of urgency. However, for investors, there are no surefire winners and the days of renewable assets delivering attractive yield as an asset-based bond are probably behind us. Value is shifting to new segments of the chain and new technologies. A deep understanding of these business models will be key in the future to navigate investing in the energy transition.

[1] EU JRC Technical Reports (2018) Green hydrogen opportunities in selected industrial processes