PERSPECTIVES #1

Can Energy Transition only be about more Renewables?

Download the full document in PDF formatLast June, the “New Energy Outlook” (NEO) team of Bloomberg New Energy Finance (BNEF) was in Paris to present the latest release of this reference document for the energy sector. The BNEF NEO struck by the depth of its analyses, and the breadth of content.

As always, the BNEF NEO team did not just publish quality data, it took a perspective, delivered to the audience with an impeccable style. The angle this year was that of determining the least-cost-option going forward (2030, 2040 and 2050) to meet electricity demand while trying to achieve the 2°C scenario by 2050 developed by the International Energy Agency.

While this 2°C objective appears less and less achievable, BNEF perspective seems at odds with a fundamental principle of sustainability: all economic decisions should be based on the best efforts to take externalities and unintended consequences into account.

In our views, the complete disruption in the energy system came not only from a technological disruption that brought down entry barriers (renewable energy sources, decentralized energy, smart grids…) but also from a rising environmental awareness based on the progressive recognition that anthropic CO2 – a major externality of the energy system – is playing a key role in climate change.

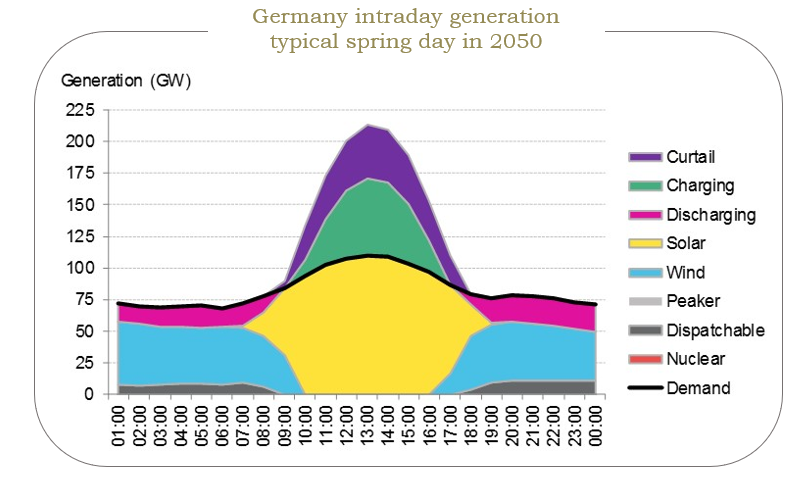

The chart below shows intraday power generation balancing demand during a typical spring day in Germany in 2050 according to BNEF:

BNEF views are that cost reduction in wind and solar and in batteries will be such that massive deployment of these technologies will be the least-cost-option to cope with both electricity demand AND system stability.

Balancing between supply and demand in any point of the day will be managed with large installed capacity of solar and wind during peak hours, and batteries during off-peak hours. It implies that to meet slightly more than 100 GW of demand in Germany:

- More than 200 GW of capacity will have to be installed coupled with a large pool of batteries providing for night, early morning and early evening loads, when the sun is not shining, and

- Roughly 40 GW of capacity will be curtailed (i.e. forbidden to be sent on the electricity network and ultimately lost), equivalent to the whole of solar installed capacity in Germany by end 2018.

This perspective is based on very thorough analyses on the cost competitiveness of wind and solar against gas and coal, on the cost competitiveness of batteries against dispatchable bulk energy sources in order to address the need for additional flexibility in the system and on the cost of “lost energy” (curtailment) for the system. In all scenarios, gas-fueled power generation is made uncompetitive by a combination of CO2 price, decreasing wind, solar and batteries costs between 2025 and 2030 (depending on the countries), and coal will also be uncompetitive between 2025 and 2035.

What this study on least-cost-option does not consider though – especially for the curtailment, is the second law of thermodynamics. This principle states that any real physical transformation (through a chemical, mechanical and or any physical process) creates entropy. In this case, entropy is a synonym for “disorder”, or externalities.

Typically, CO2 is an unintended consequence of producing energy. It is the result of human decision to use a fossil energy source to power a system, creating entropy by burning this fossil energy source (e.g. coal or gas).

However, it would be wrong to consider that renewable energy sources do not generate entropy. Since “capturing” the energy of wind, solar or hydro requires equipment and infrastructures, it creates entropy. Analyzing the merits of renewable energy sources without recognizing this entropic content would lead to fundamental mistakes, very akin to those that led to partial views on the genuine cost of conventional and nuclear energy in the past.

In the recent years, externalities of the conventional energy system have been progressively unveiled to be – imperfectly – integrated in the economics of these technologies:

- CO2 for coal and gas through CO2 pricing, but also particles emissions for coal through legal emissions thresholds;

- Dismantling of nuclear power plants and handling of nuclear waste: as the German case showed, end-of-life costs for nuclear can be very substantial. The provisions for nuclear waste handling were increased by 35.5% (to total 24 bn€) at the request of the regulator in exchange of capping the cost of disposing of nuclear waste for the private operators and ultimately transferring the risk to the State as guarantor of last recourse. The cost of dismantling has been so far provisioned by operators for an amount up to 22 bn€.

Another issue in assessing least-cost-options without integrating externalities is that it may lead to an irrational use of resources. If a commodity or a resource is priced at a cost that does not reflect the full life cycle cost, it will very likely be over-utilized, without considerations for the externalities generated and for the energy consumption sobriety which is a pillar of the energy transition.

An extreme but emblematic example of such a situation is the use of natural resources in the former USSR: the abundance of cheap gas used to heat collective buildings led to abnormal situations where people opened window during harsh Russian winter to cool overheated flats.

The implications in terms of pollution were at the time unaccounted for nor were they a significant concern yet. It does not change the fact that these irrational behaviors stem directly from the absence of awareness and understanding of unintended consequences and externalities in general.

In the case of massive deployment of wind, solar and batteries, the full life cycle analysis would need to encompass several fundamental externalities attached to these technologies:

- The cost of recycling, especially of solar panels. To date, except for the EU and its WEEE (Waste Electrical and Electronic Equipment) Directive, solar panels are treated and considered as standard waste. Just discharging solar panels in landfills is not an option, as this equipment contains some amount of toxic substances. It would also be a total waste of resources as over 90% of a solar panel can be recycled. But recycling the glass, the plastic and the aluminum, which are the main components of a solar panel has obviously a cost to be factored in the Levelized Cost of Energy (LCOE);

- The scarcity (by definition) of rare earth materials, with recycling costs issues and potential geopolitical repercussions. As an example, in 2016, only 7% of the Tellurium used in Cadmium-Tellurium (CdTe) thin film modules was recycled. No Dysprosium recycling facilities is operational yet, although this component is critical in Wind Turbine Generators’ permanent magnets and 25% of Dysprosium use comes from the energy sector;

- The possible competition for land use in regions of high population density, where sustainability would then have to be assessed not based on the displacement of emissions related to energy production, but also based on the possible arbitrage between local agricultural production and energy production.

On top of these externalities, the high penetration rate of wind, solar and batteries in the energy system will also require an evolution of the management of the electricity transportation and distribution networks. And this is a key point of attention of the power sector today. The costs related to a more complex and flexible management of networks are also a type of externality to be factored in. As a point of reference, a study from the European Union pointed out to over 1000 bn€ the cost for grids only of shifting from a Current Policy Initiative scenario to a High RES scenario between today and 2050i. While foreseeing a more than five-fold increase of flexible capacity between 2015 and 2050, by considering massive curtailment as a feature of the future energy system, the BNEF scenario eventually implies that this externality of “system cost” is in fact partially replaced by other externalities, as described above.

But integrating externalities is not only a critical component of the practical debate around the relative merits of various energy technologies and the investments orientations. It is also a fundamental debate on the underlying economic theory that will drive investments in the future, determining to a large extent whether sustainability does imply a change in the economic foundations of our decision making, or if it barely “greens” it.

For recollection, Investment Theory is largely based on two key pillars:

- the Capital Asset Pricing Model developed by Markowitz in its seminal article of 1952 and later developed among others by Sharpe in 1964, which underpins the whole methodology of discount rate and valuation theory;

- the agency theory – developed in 1976 by Jensen & Meckling – that makes of shareholder value maximization the founding principle of a company’s governance, considering that shareholders are the only party having “residual rights” on the company’s cash flows.

These two theories have a direct link to the debate around the least-cost-option put forward by BNEF, under two interlinked topics : 1) discounting methodology leads to dismiss the real cost of dismantling and recycling, as it happens far away from today’s decision and 2) agency theory recognizes that shareholder value maximization leads to the optimal social welfare (that could be here considered as sustainability) to the extent that externalities are neglected :

“To be sure, there are circumstances when the value maximizing criterion does not maximize social welfare – notably, when there are monopolies or externalities. […] By “externalities”, economists mean situations in which decision makers do not bear the full cost or benefit consequences of their choices or actions.”ii

Recognizing the value of externalities – positive (e.g. improvement of public health) or negative (e.g. climate change or pollution) – is hence a critical component of changing our approach to economic decision.

BNEF’s analyses are by all account sobering. When in Paris, we briefly discussed the topic with Seb Henbest (Head of EMEA of BNEF) and he very coherently argued that the scope of the study was solely to determine the least-cost-option to meet electricity demand while trying to achieve the 2°C scenario by 2050.

This is precisely because these analyses are remarkable in their quality that it is important to position them in the broader perspective of sustainability, which should be one of the fundamental drivers (with affordability) of the energy transition. Let’s hence try to avoid reproducing the same shortcomings as those underlying the decision making of the “traditional” energy world.

There are little doubts (if any) that renewable energy sources should and will constitute the reference technologies of energy production for the future. But in order to ensure that sceptics or people who oppose renewable energy sources or the broader sustainability agenda do not have strong grounds to their criticism, it is key we offer a full view of the economic merits of these technologies.

In terms of investments, energy transition calls for a comprehensive view of the energy system, to ensure that investment decision will heed both the need for affordable energy and environmental sustainability. For this reason, solutions allowing to reduce consumption, displace costly infrastructure investment, or enhance the flexibility of the system must be developed. Because renewables are a much-needed solution to decarbonize energy production, we must ensure that system’s intelligence and efficiency improve as renewables penetration rate increases. And we must start thinking more systematically in full cycle analysis to avoid pushing blindly forward issues to future generations.

[i] EUROPEAN PARLIAMENT – DGIP European Energy Industry Investments, Study, 180pp

[ii] JENSEN M.C. (2001) Value Maximization, Stakeholder Theory, and the Corporate Objective Function, Working Paper No. 01-01, Negotiation, Organization and Markets Unit, Harvard Business School: 21p.