Critical Raw Materials: Africa as the next strategic partner for the European Union?

PERSPECTIVES #8

Europe is seeking to design an ambitious regulatory framework to steer its economy and policies towards sustainable development and the fight against Climate Change. It is obvious when looking at the European Green Deal and its goal to be Climate Neutral by 2050 but also in the development of the sustainable finance corpus: Sustainable Finance Disclosure Regulation (2019) and EU Taxonomy (2020).

Among the key tools for achieving this ambitious goal lies the EU Emissions Trading Scheme (EU- ETS) that has been implemented in 2005. The basic idea of this scheme is that main CO2 emitters (energy producers, heavy industries and later on aviation) must eventually pay for the negative impact their activities have on climate through Greenhouse Gas (GHG) emissions.

This scheme has been of growing importance to economic decisions in the power and heavy industries sectors for the last 15 years. In the context of the European Green Deal, a revision of the EU-ETS directive is being discussed, likely to lead to a more comprehensive scope that may impact not only large corporations or industrial sites, but increasingly SMEs and midcaps.

EU-ETS being a key instrument for a successful energy transition, we intend in this paper to:

1. Give a brief overview of this scheme;

2. Discuss the impact of CO2 pricing on emissions reduction;

3. Question two key features of the EU-ETS: what are the implications of considering CO2 allowances as a financial asset and how does this scheme play into the European Just Transition ambition?

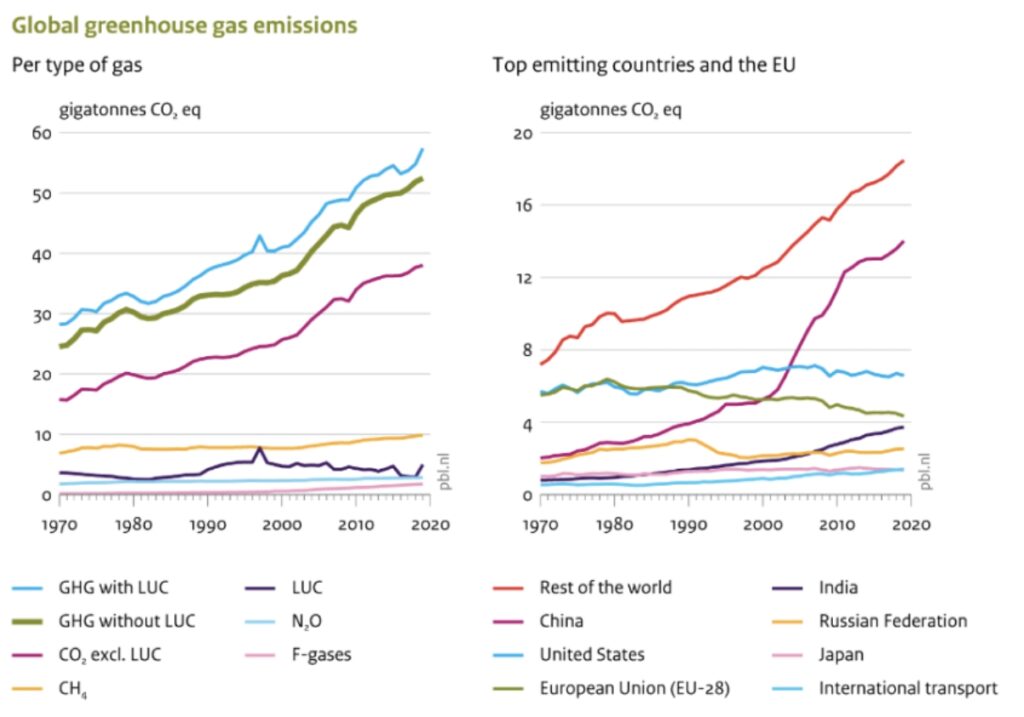

With 3.8 GtCO2eq, the EU-27 represents roughly 7% of the global GHG emissions, roughly 8% when accounting for the UK. The EU is the only region to have substantially reduced its emissions since 1990, achieving a 21% reduction.

Between 1990 and 2005, the yearly reduction rate has been of c. 0.4% and of c. 1.2% from 2005 to 2019. 2005 is the date of implementation of the EU- ETS Scheme.

Although it is difficult to attribute to this framework alone all the merits of the reduction, we consider the EU-ETS as a central piece of the EU arsenal to combat climate change.

A quick view of the functioning of the system is necessary to understand the potential implications on investment decisions.

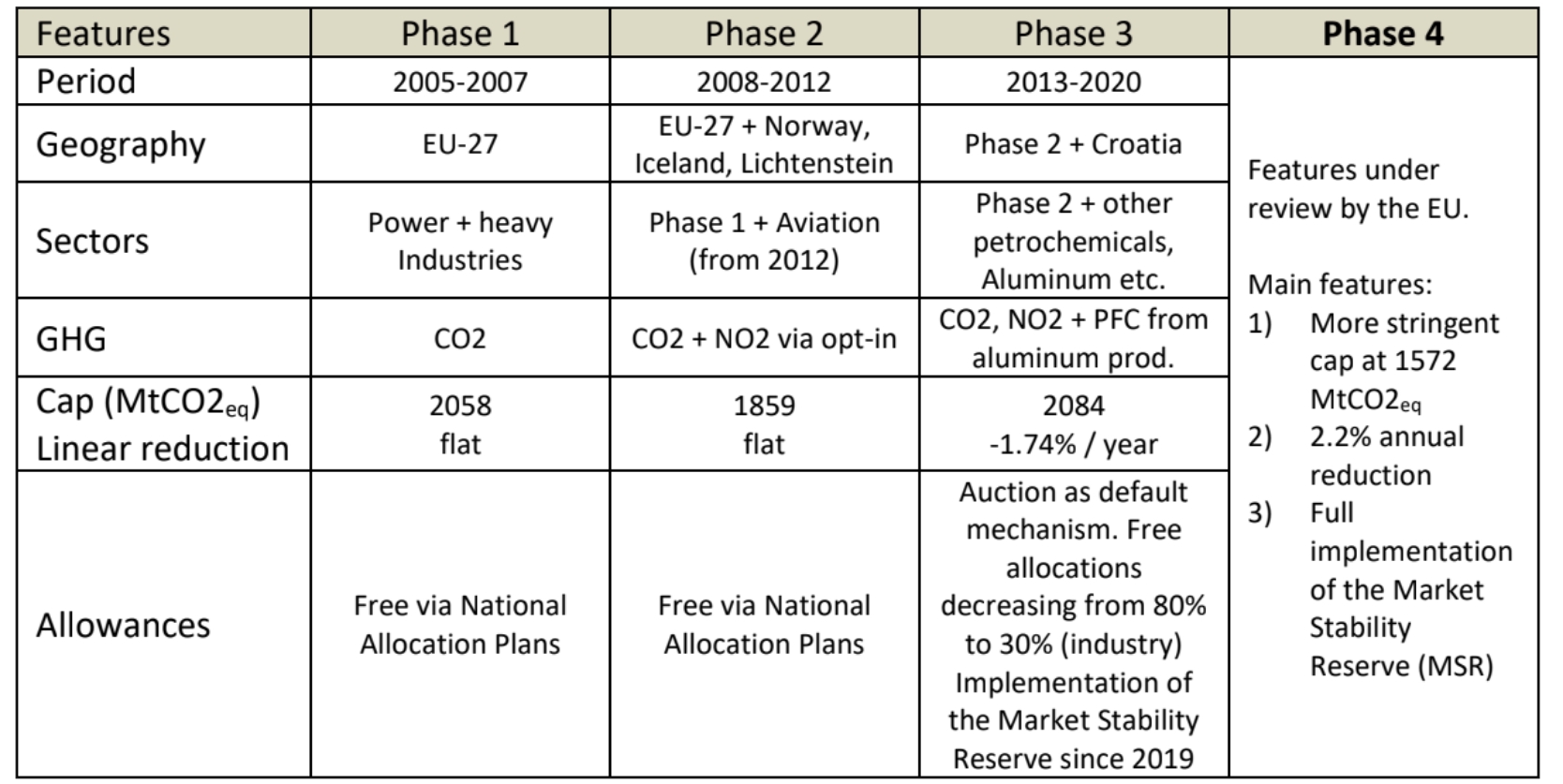

The EU-ETS covers 11 000 energy heavy installations and air traffic, representing around 40% of EU emissions. Its implementation has been phased, to allow actors most impacted (power generators and industrials) to adapt progressively to the integration of the CO2 externality in their decisions. Four phases have been established.

The phase 4 that is still in discussion and aims at setting higher goals for the EU, in line with the European Green Deal and its goal to bring the EU on the trajectory to the Paris Accord. It also aims at remedying some of the shortcomings of the system highlighted in the first three phases.

For example, in the face of the financial crisis, mishaps and overly generous National Allocation plans combined with a massive recourse to international emissions credits (Certified Emission Reduction and Emission Reduction Unit) during phase 2, a surplus of allowances has built up since 2009, triggering a high volatility in the price of the CO2 allowances since its appearance in 2005. It went from a low of less than 3 €/t in April 2013 to a current high of nearly 40 €/t.

To remedy this situation, the Market Stability Reserve is introduced, to control the number of allowances available by taking out allowances when the surplus is above 833m and reintroduced later on if the surplus drops below 400m. This mechanism ensures liquidity in the system while preventing major price swings, and specifically too low allowance prices that would hurt the goal to decarbonize the economy.

Debates have been and are still going on regarding whether a cap-and-trade model such as EU-ETS is better or worse than the alternatives such as a carbon tax or a control-command approach. In our view however, the central question is much more the effectiveness of these policies with regards to emissions reduction.

As longtime energy investors at TiLT, we have little doubts that carbon pricing has had two major impacts on the power and energy industry: 1) it gave body to an intangible externality and has brough climate change into management committees and board rooms and 2) it has helped shift investments to lower carbon intensive technologies and solutions.

However, core to the relevance of carbon pricing on emissions reduction is the issue of identification: GHG emissions levels are the result of a wide array of physical, economic, social forces, such as it is difficult to identify the impacts of one policy alone on emissions reduction.

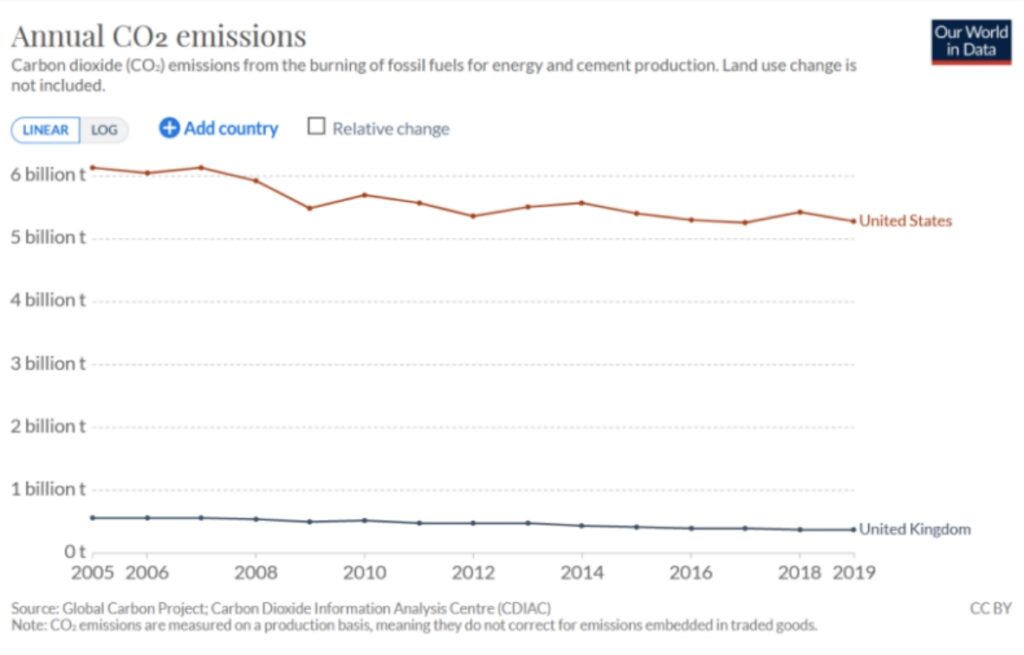

Comparing the UK and US CO2 emissions over the last 15 years can help grasp this issue of identification when it comes to impact of carbon pricing on emissions reduction.

In the last 15 years, the UK has reduced its CO2 emissions from 570 Mt to 370 Mt, or a 36% reduction. Over the same period, the US went from 6100 Mt to 5300 Mt, or a 13% decrease.

The striking feature is that the US does not have a federal carbon pricing mechanism, when the UK has implemented one since 2013.

One of the key drivers in these reduction trends in both countries has been the coal-to-gas switch (not the carbon pricing), which happened in both countries for different reasons:

– In North America, the unconventional hydrocarbon boom of the late 2000s led to a dramatic decrease in natural gas prices since 2012, with prices oscillating between $2 and 4$ per MMBtu, vs. an average of 8$ between 2003 and 2010. While the US still has significant coal reserves, gas prices were so low that it made it structurally efficient to close coal power plants or retrofit them to gas combined cycles. Despite cheap domestic coal resources, cradle to still a significant number of jobs, gas prices determined the US moving away from coal, hence reducing their emissions.

– In the United Kingdom, coal production was divided by nearly 10 between the peak of 1970s, when gas production peaked in early 2000s and then decreased to about 40% of this peak as the UK fields depleted. The UK was hence relying increasingly on coal imports, which peaked in 2013, while the US was a net coal exporter. Energy being a strategic topic in terms of independence, it is likely the UK coal-to-gas switch was also driven to a certain extent by strategic considerations and not only by placing a price on CO2.

The goal of this short example is to highlight that CO2 pricing alone cannot suffice to curb emissions and mitigate climate change. It is an essential part of a climate policy, but it cannot be the sole pilar.

In fact, a Cambridge Faculty of Economics working paper made an extensive study of the effect of carbon pricing on emissions reduction1. The main conclusion is that across the various schemes studied, the impact of carbon pricing on emissions was a reduction ranging from 1% to 2.5% per year. This is also in line with a 2020 OECD study2 that leads to the same order of magnitude when analyzing the impact of the French Carbon Tax on emissions: over a 5-year period, the carbon appears to have reduce the emissions by 5%.

This tends to confirm that putting a price on carbon, whether through a cap-and-trade mechanism or through a carbon tax, has a direct impact on emissions reduction. It is coherent with the theory predicting that pricing negative externalities should lead to a mitigation of these externalities. Given the urgency and the complexity of the challenge ahead, a key question then becomes the functioning of the scheme, and its adequation with the goal of achieving carbon neutrality.

Regulatory stability and predictability are key to long term investments. Yet, in the energy transition sector, the perspective of genuine emissions reduction takes an increasing place in investment decisions. This is reinforced by the regulatory framework the EU has set forth with the “Taxonomy” and “Disclosure” regulations. To put it bluntly, a stable regulatory framework that would fail to steer economic decisions towards the Paris Accord trajectory could be seen today as prone for future changes, and hence risky. With this in mind, we are convinced that the EU-ETS could gain further support and credibility – including from the financial community – in curbing EU GHG emissions if it took on board several main evolutions that would provide a minimum price certainty and align its features on the Paris Agreement.

Three are well known and fairly advanced:

1) the Market Stability Reserve is a powerful tool that goes in the right direction. Likewise, setting a floor for CO2 allowance price would provide

greater clarity that the social cost of GHG emissions cannot be minimal anymore and will need to be factored in for the long run3.

2) The annual reduction in the allowances cap should be in line with the 2°C trajectory set out by the IPCC and used as a minimum reference in the Paris Accord. To achieve this goal, emissions should be reduced by 2.7% per year over the next decade across all sectors according to the UNCC. Indeed, Europe is not the biggest contributor to global emissions, but it has been and should hence set its allowances cap reduction for phase 4 of EU-ETS well beyond 2.2% per year. In this respect, the prospect of a higher Linear Reduction Factor in the revised ETS directive that should be released in June 2021 would certainly go in the right direction. We should also keep in mind that to achieve 1.5°C, the UNCC considers the

annual reduction of emissions should be 7.6% over the next 10 years.

3) The EU-ETS perimeter should be expanded to cover all major economic sectors of the EU. Despite all its positive impact on emissions reduction, the EU-ETS covers only 40% of the bloc’s emissions, watering down significantly its impact as a key policy tool.

Two other and more sensitive evolutions would have a significant impact on emissions reduction if implemented, considering that this is the ultimate goal of pricing GHG emissions:

4) CO2 allowances being traded as a financial product4, there is growing concern that the price of the allowance will be increasingly subject to financial speculation. Aware of this risk, the EU has regulated to reign in the emerging trend by including CO2 allowances as Financial Instruments under MiFiD II, and not only derivative contracts of emissions allowances. The direct consequence is that it places the Carbon market in the scope of the Market Abuse Regulation (MAR), which aims at ensuring transparency in markets and prevent market manipulation and inside information.

Yet, the more critical question that may arise is the role of different players in this market and the impact of their behavior on price. The EU-ETS is a compliance market which seeks to determine the least cost option in meeting a cap of allowed emissions. But it has been set up as a financial market, which justification is the need for hedging and liquidity.

The hedging component is linked in part to the price uncertainty stemming from the free auction mechanism: free allowances are awarded in February of year N and must be surrendered in April of year N+1 in order to achieve compliance. Problem is: while futures are necessary instruments for compliance players to hedge their short price exposure, it paves the way for active speculation.

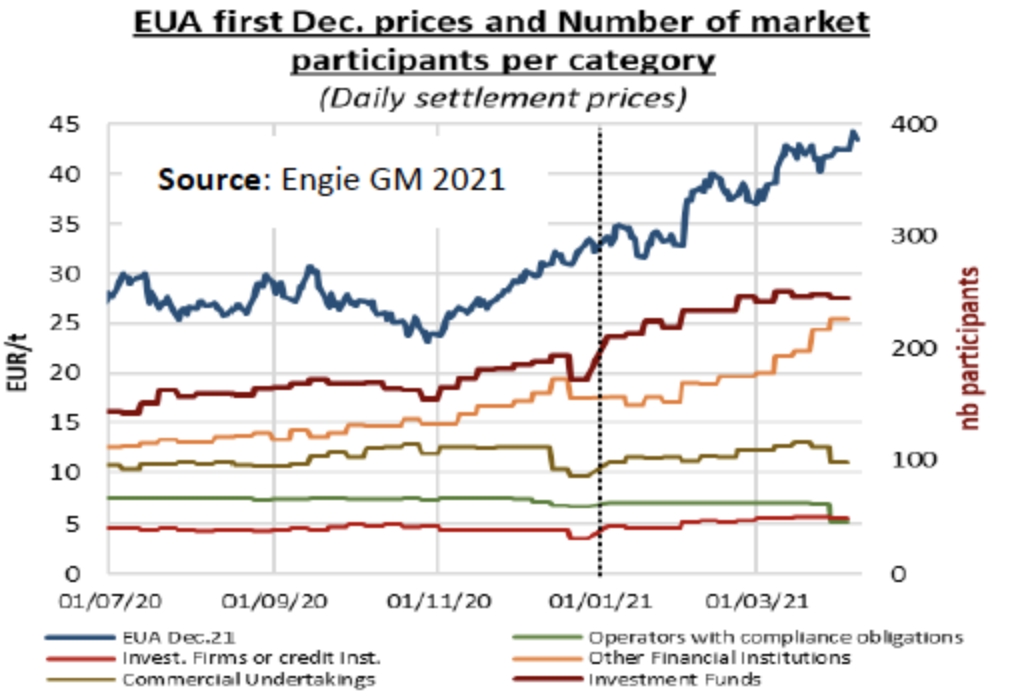

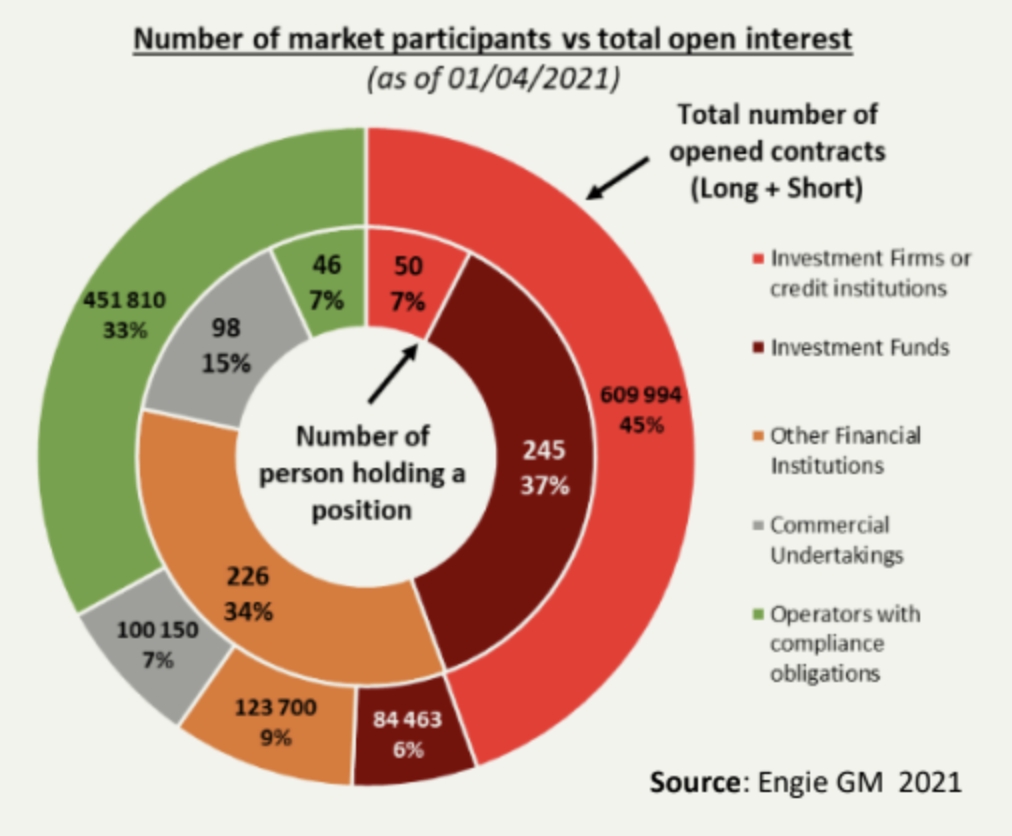

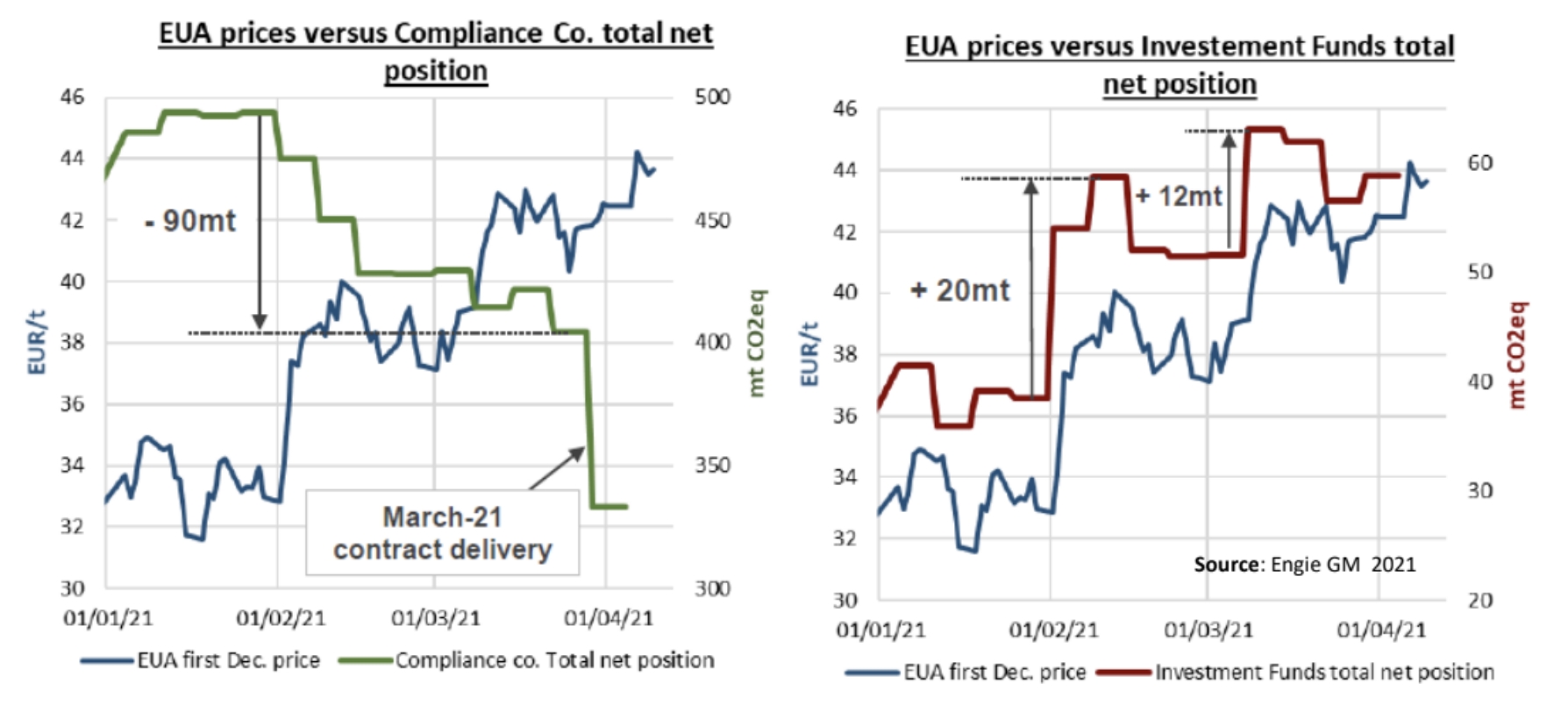

Indeed, the recent trend in EUA prices suggests that speculation is a significant, and potentially the main driver behind the price hike. This shows in the trend of markets participants by category: in the course of less than a year, investment funds and other financial institutions have nearly doubled in numbers of market participants.

In the same time, the number of compliant operators and credit institutions that are their counterparties in deals using EUAs as collateral, remain logically stable. Operators steer their operations in order to 1) comply with the permits they’ve been allocated factoring in the annual decrease, and 2) to maximize emissions reduction, deriving potential revenues from their increased efforts (either through investment and / or operations optimization).

Yet, the current trend may put these operators in a troublesome situation. While the increase in carbon prices is indeed called for, the pace of the price increase may raise concern. While climate change is a global threat, Europe must – and does – consider that high CO2 prices has an impact on its industries’ competitiveness. While the discussions on Carbon Border Adjustment Mechanism aim at solving part of this issue, it does not capture the issue of inelasticity of installation optimization to carbon prices.

Hence the importance of the categories of markets participants and their impact on prices. The following chart below shows a defining feature of the current EUA market: “fundamental” markets players, such as compliant operators and credit institutions account for over 80% of open interests, while representing just over 15% of market participants.

Combined with the net positions of these players and that of the investment funds against the recent EUA price curve, the story that emerges is that the recent dynamic has been mostly driven by speculative players rather than by fundamentals. This has also been highlighted in the press recently and studied in a number of academic papers and research5.

Since the beginning of 2021, the price has gone up over a third. While net positions (difference between long vs. short positions) of compliant players have gone down by nearly 20%, net positions of investment funds have increased by 60%. Strikingly, the price curve appears to be well correlated to the investment funds net positions.

The installations considered under the EU-ETS are generally large complex power plants or industrial sites. They cannot be optimized overnight to compensate for prices increases, leaving as only option a financial hedge through futures contracts. However, as in any financial market, hedges are assessed against the current price in the market. If the market tanks while these compliant operators have hedged at much higher prices, the unwinding of hedges will lead to a loss, creating a potentially significant uncertainty over their financial situation.

If history is to teach us a lesson, especially the 2008-2009 crisis, it is that instruments intended to provide liquidity or insurance, when left in the hands of unregulated or loosely regulated players, lead to sub-optimal social states, to say the least. The effectiveness of the EU-ETS is something too serious to be subject to the traditional issues of financial markets functioning.

Hence a provocative proposal: ban investment funds from operating on the EUA market. It would not prevent banks and other credit institutions to remain key players of this market, driven by fundamental needs of compliant operators. It could however be a means to prevent speculative players by nature to determine the dynamic of the highly sensitive topic of adapting an industrial asset base to climate change.

Otherwise, the risk is that of a backlash against the EU-ETS functioning, paving the way for unnecessary debates over the scheme itself. It could reignite the debate over the relative merit of a carbon tax seen as more predictable, and immune to speculation on GHG emissions. Yet, we know that determining the level of such carbon tax and having to adjust its level over time is in itself a genuine difficulty.

5) EU-ETS market proceeds will largely determine the social acceptance of the efforts required to fight climate change. As CO2 costs will certainly be pass-through to customers in energy or products costs, the risk is that energy transition is perceived as an additional burden on vulnerable populations within the EU, or on small businesses.

A 2013 ADEME study on Energy Poverty in France finds that between 2.8 and 3.8 million households are in a situation of energy poverty, with the poorest households spending 15% of their income in energy expenses. Any increase in energy costs will likely be unbearable, as the “yellow vests” movement of 2019 in France may suggest.

Equally for small businesses, implementing tools to manage the CO2 risk will require significant resources, human and financial, as they will need to: implement an emissions monitoring tool, determine how emissions costs will impact their commercial strategy, potentially audit emissions level and targets, assess investments against their “climate compliance”, etc.

Allocating CO2 proceeds to adequate support for vulnerable households and SMEs is critical, and directly in line with the Just Transition advocated by the EU. Experience suggests that it should take the form of structural investments (building renovation, training, R&D, fiscal incentives for clean investments) rather than direct subsidies that will anyhow be questioned under EU and international trade regulations. But absent this component of proceeds allocation, there is a high risk of growing discontent and criticism of the EU-ETS, despite its evident merits.

Carbon pricing is central to a sustainable economy. Its more important feature is that it signals that GHG emissions can no longer be ignored when forming decisions. It is a major step in the right direction, departing from classical financial theory that assumed the absence of externality to compute optimal outcomes through shareholder value maximization.

Let’s not miss the opportunity offered by the strong momentum behind sustainable finance and the growing call for action against climate change: CO2 pricing must be a tool to steer the adaptation of our industrial asset base in order to achieve the goals of the Paris Agreement. We cannot afford to be distracted by speculative behaviors that have systematically led to disastrous outcomes eventually, on every market where it became prominent. To paraphrase Christine Lagarde’s analysis of the financial crisis in 2008, let us not create the condition for a crisis of “hubris” in the much-needed carbon market.

However, carbon pricing alone will not put the EU nor the world on the path to a 2°C – even less 1.5°C – trajectory. It needs to be included in a wider ensemble of policies. That is precisely the merit of the EU’s stance over the last 5 years.

We have highlighted before (TiLT Perspectives #3 and #5) that energy transition requires a comprehensive approach, to give investors a sense of coherence and unavoidable trend. We firmly believe that Phase 4 of EU-ETS provides a chance to further improve this central piece of policy. But EU should go beyond the technicalities of the CO2 pricing: it will need to design a transparent and ambitious CO2 proceeds allocation scheme to offer inter-states solidarity, to bring on board the populations of the EU that will be impacted by the energy transition, while ensuring that European business maintain and increase their competitiveness.

The challenge is overwhelming, but the most recent signs coming from the EU are very encouraging for an investor in the Energy Transition.